How nice it would have been to have Vema Trader around when I first got into trading. As a trader who has lived the majority of their life in Australia, the main annoyance I have ever had (with the exception of losing money) is missing out on trades. I am sure many can agree on the annoyance one has when you’ve set the trade you want to take. You wait patiently for the price to move toward your intended entry point. Only to have the move take place whilst you are asleep!

For the most part, this would be because of the majority of the decent moves within the market. Take place between 12 am and 7 am with no guarantees of when or if it will actually happen the way you foresee.

Insert Vema Trader a powerful trading platform that can alleviate this exact problem.

What is Vema Trader?

Table of Contents

- 1 What is Vema Trader?

- 2 What are the Key Functionalities?

- 3 How Does Vema Trader Work?

- 4 Does Vema Trader Require Technical Analysis?

- 5 Why is Vema Trader the Best Fully Integrated Trading Platform?

- 6 What is the cost of Vema Trader?

- 7 FAQs

- 8 Which exchanges support Vema Trader?

- 9 Does Vema Trader work with Trading View?

- 10 Can I Place Trades in Spot and Future Markets?

- 11 How does Vema Trader stop liquidations?

- 12 My Final Thoughts On Vema Trader

Vema Trader is likely to be the most powerful trading platform for emerging traders in the crypto and forex markets. The reason being it allows you to set your trade plans and trigger entries automatically based on the conditions you have set for the trade.

Obviously, allowing people who are at the beginning stages of their trading journey. To do their technical analysis on charts they are interested in, set the trade, and let it play out. Without the need to be sitting in front of the computer waiting for the optimal to enter the trade.

Whilst I have made a large emphasis on Vema Trader being great for beginners. This trading platform is not only for people who are time-poor. As you will read in the next section there is a range of functionalities that can be considered a great asset for a trader of any skill level.

If you are kicking yourself for missing the most recent move or you want to set multiple entries whilst trading patterns. This is the platform that allows you to unchain yourself from your computer. Whilst knowing you are prepared for your upcoming entries.

What are the Key Functionalities?

Entry Strategies

Essentially there are four main entry strategies you can use for a single trade. Within Vema Trader your main point of reference is called the Alpha Line which you will see in the images below:

Quick Entry:

You could be in the process of setting your trades and you see the move happening before your own eyes. Utilizing the ‘quick entry’ will allow you to ape straight into the trade at market rate going long or short.

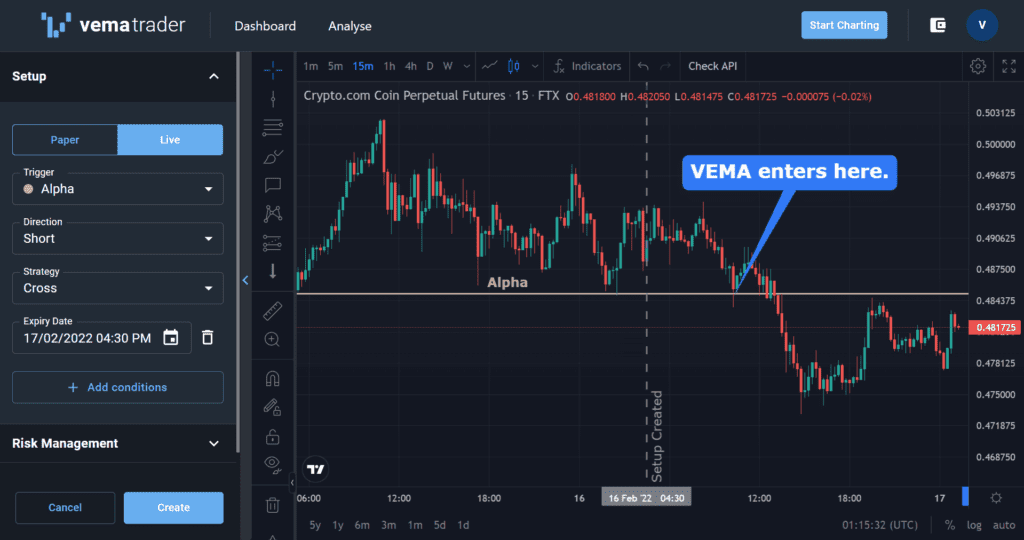

Cross Strategy:

Let’s say you expect the price to break through your trendline support or resistance and carry on in the same direction. You can use the ‘cross entry’ to set the price you wish to buy in at (just above the trendline) to catch the move. Side note you can also add conditions for your buy in i.e candle closes or expiry dates.

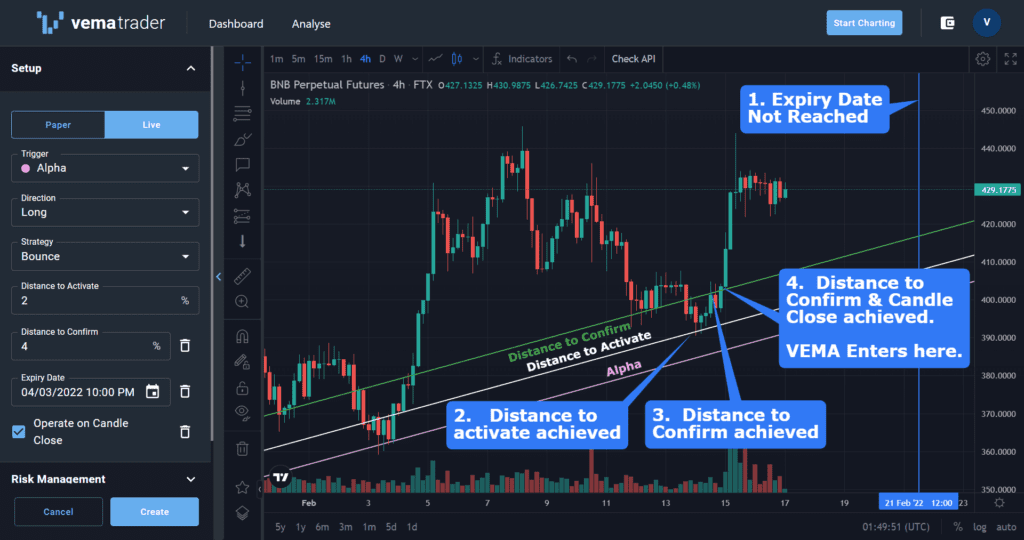

Bounce Strategy:

The bounce strategy works best when the price moves aggressively toward support/resistance especially the first time of contact. The conditions you can set within the platform allow you to preset your timing on how you want to enter the bounce trade if it plays out as you expect. The order that VEMA’s Bounce strategy conditions must be met is:

1. Expiry date not reached

2. Distance to Activate (Avoid getting front-run)

3. Distance to Confirm (Confirm Rejection)

4. Operate on Candle Close (Stop Hunt Saviour / Avoid Wicks)

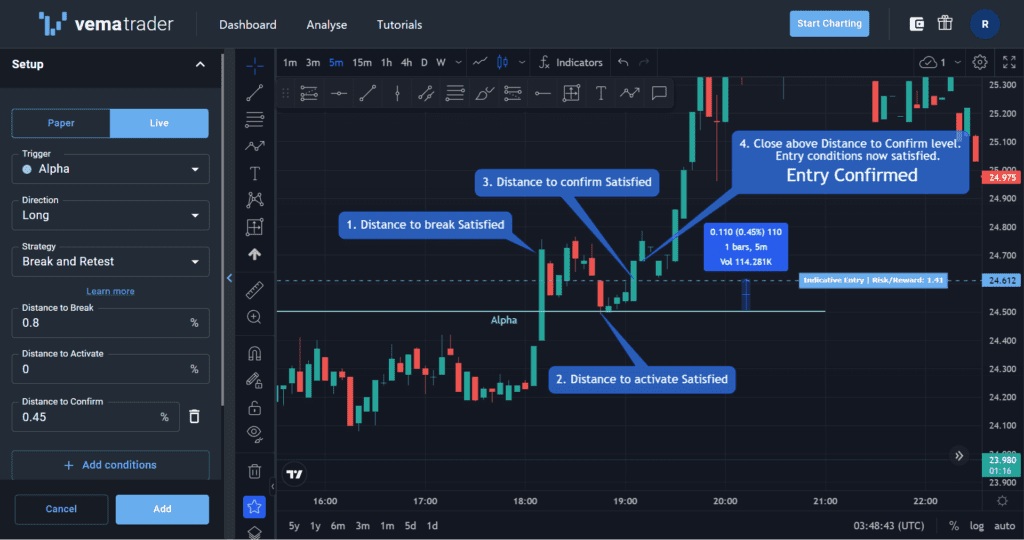

Break & Retest Strategy:

One of the most common scenarios to play out is price breaks through a level then comes back to test the support/resistance before moving further in the breakout direction. Once again you can set the conditions you want in order to validate your trade before entering and preset it. The order that VEMA Break and Retest conditions must be met for entry is:

1. Distance to Break (A candle must close outside this distance)

2. Distance to Activate

3. Distance to Confirm

4. Operate on Candle Close

Journal

Everyone I have chosen to follow in my trading journey has always stated the importance of journaling your trades. You may be wondering to yourself why do I need to write down all the details of my trades. Well if you don’t know by now I will let you in on a little secret. The whole process of trading is a game of probabilities.

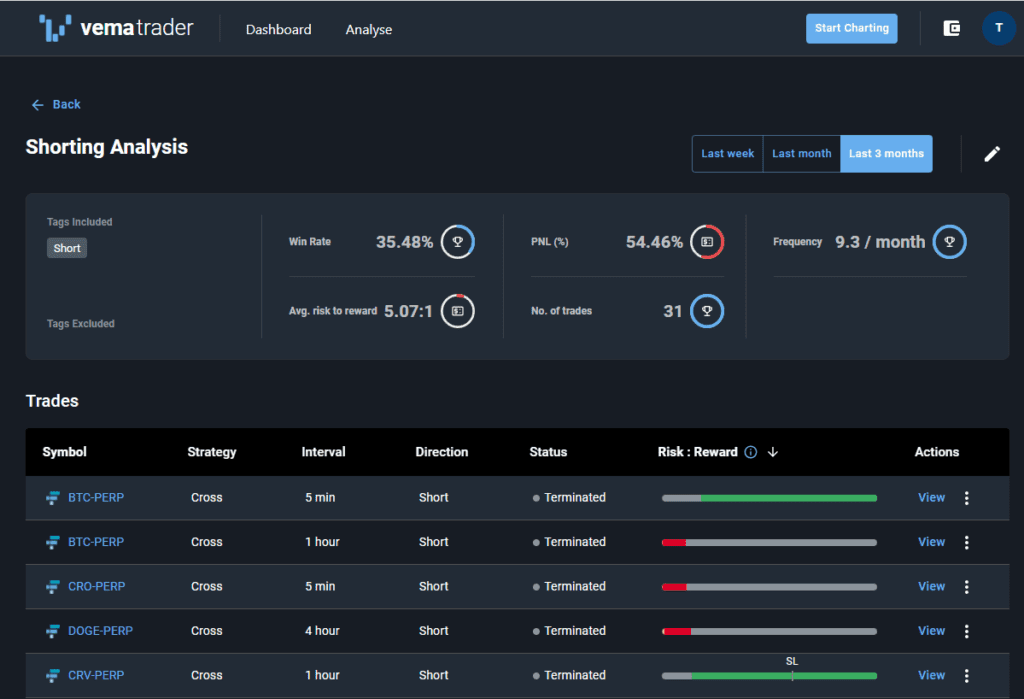

Journaling will allow you to recap and understand emerging patterns that play out. It will give you the data to look back and see what worked and what didn’t on each of your trades. Vema Trader allows you to journal directly on the platform citing your mood, and confidence, taking notes and adding tags.

Paper Trading

A paper trading account can be used to get familiar with the platform you can purchase this option for $29AUD per month. The paper trading feature allows you to become accustomed to the platform before putting your money on the line and running the risk of losing funds due to a trade being set incorrectly.

You can also use the demo feature on the website to get an understanding of the platform and how the simple interface is easy to use.

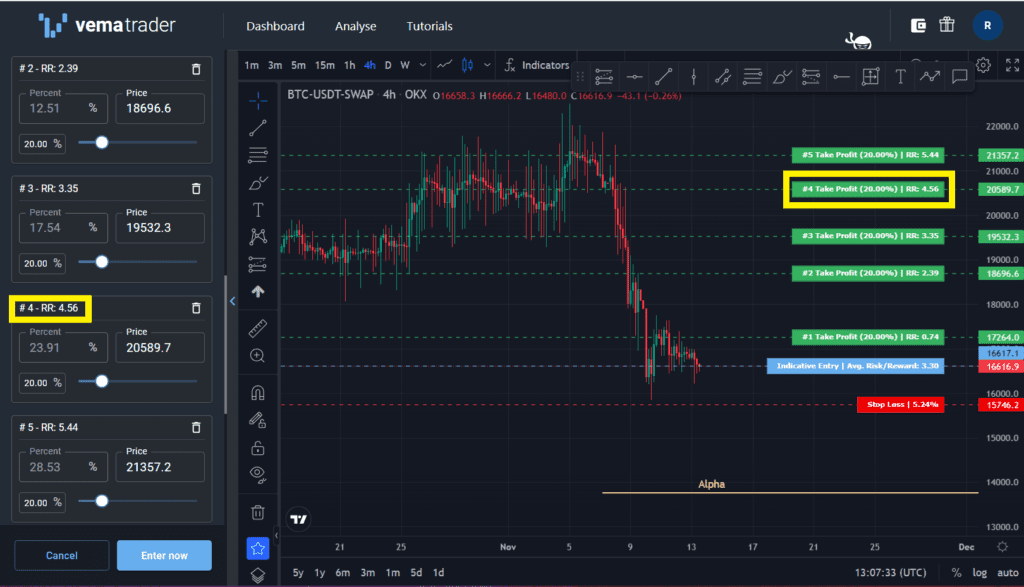

Take Profit Options

There are both Limit and Market order options. Each has pros & cons but it is better to have the option of both rather than be stuck with only one. Especially in times of volatility.

Trade Longs & Shorts

As you will be trading Futures you have the option to trade both long and shorts. If you are unaware of what each means, a long is when the price is trending upward and you enter a trade expecting it to go up. A short is when the price trends down and you enter a trade with the expectation the price will go further down.

Trigger

A trigger is based on your conditions when it meets the point of reference the Alpha Line or if you have multiple triggers set the Bravo and Charlie lines.

Tagging Trades

Tagging allows you to catalogue your data inside Vema. This makes it easy for you to filter through the information of your trades.

How Does Vema Trader Work?

Vema Trader connects to multiple exchanges allowing the user to enter and exit trades. From single entry and exit as well as staggered entry and exit based on the conditions you set. You will need to manually transfer your Trading View chart data to set your conditions on the Vema Trader charts.

Does Vema Trader Require Technical Analysis?

In short, yes. In order to be able to utilize all the features you will need to have at minimum a basic understanding of technical analysis. I would say Vema Trader is more aligned to your trading account i.e. exchange rather than your Trading View Account. As stated on their website Trading View software development kit is used but you cannot log into your own Trading View account.

Why is Vema Trader the Best Fully Integrated Trading Platform?

They have no direct competition from what I have found. There are a few products that are similar in some aspects such as Coinrule or Trading Views option for trading Forex but overall nothing else that compares regarding cryptocurrency.

What is the cost of Vema Trader?

Well, it’s not exactly cheap when you compare it to the likes of Trading View, ExoCharts or Trading Lite. What it offers is on a completely different spectrum. Vema Trader is similar in the sense you use TA to set your trades but where it differs is how it allows you to take trades within the platform. Trading View does have this feature but only for Crytpo FX. Meaning you can only trade legacy pairs i.e. BTC, ETH etc.

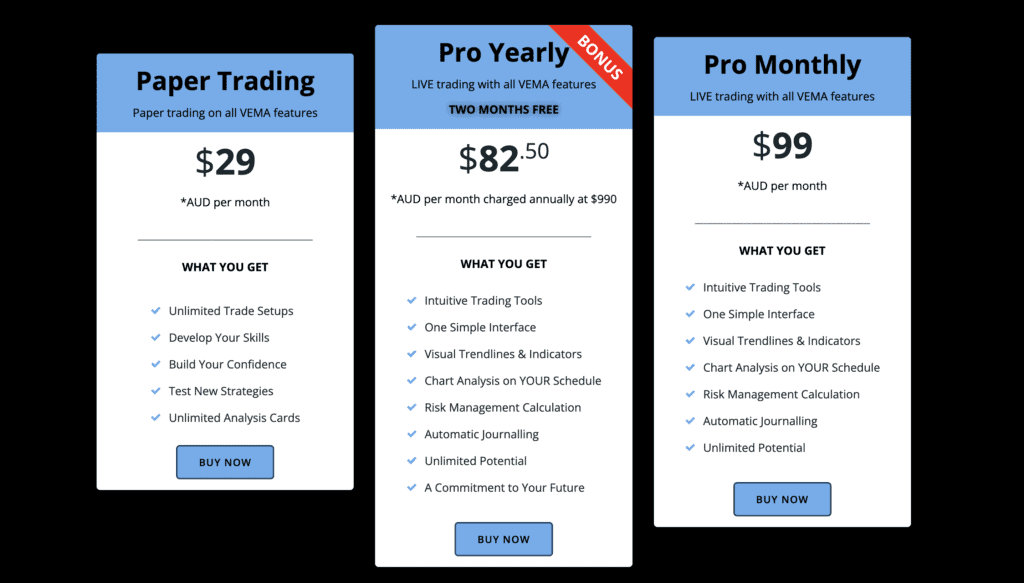

There is a three-tier structure when it comes to pricing:

Paper Trading

Benefits:

- Unlimited trade setups

- Develop your skills

- Build your confidence

- Test new strategies

- Unlimited analysis cards

Cost:

$29AUD per month

Pro Yearly

Benefits:

- Intuitive trading tools

- One simple interface

- Visual trendlines & indicators

- Chart analysis on your schedule

- Risk management calculation

- Automatic journaling

- Unlimited Potential

Cost:

$990AUD per year with 2 months free

Pro Monthly

Benefits:

- Intuitive trading tools

- One simple interface

- Visual trendlines & indicators

- Chart analysis on your schedule

- Risk management calculation

- Automatic journaling

- Unlimited Potential

Cost:

$99AUD per month

FAQs

Which exchanges support Vema Trader?

Currently, there are two exchanges that work with Vema Trader. The first being OKEX and the second BitMex. Integration with Bybit and Binance is expected in the near future.

Does Vema Trader work with Trading View?

Whilst Vema Trader uses the Trading View – Software Development Kit you cannot log into your own Trading View account on the platform. You need to use each individually but in conjunction with one another.

Can I Place Trades in Spot and Future Markets?

Currently, you can only use the platform for futures trading.

How does Vema Trader stop liquidations?

There are four different methods used to notify traders of impending liquidation. These are all in-built into the platform to help prevent liquidation from happening. The liquidation price appears in the monitoring details, under Risk Details – Stop Loss.

- Liquidation price displayed after the trade has been created.

- Liquidation levels are displayed on charts.

- Email notifications.

- Buffer the position to reduce the likelihood of liquidation.

My Final Thoughts On Vema Trader

If you are looking for a platform that automates live trades, will trigger automatically and allow you to utilize proper risk management among many other things then Vema Trader is for you.