The tax season is always a nerve-racking time. It’s particularly stressful for crypto traders as this industry is not exempt from tax in most countries. If you earn a crypto income from any of your crypto assets, then you’ll likely be expected to pay taxes.

So how do you keep track of all your crypto-related transactions, figure out taxable events and ultimately file a crypto tax report? Well, this is where crypto tax software comes in handy. This program monitors all your crypto holdings and transactions while providing an easy way to file taxes; hence, avoiding harsh penalties.

Not sure which tax program to use? In the following post, I have rounded up 9 of the best crypto tax software. You will find several options that offer free trials/ plans as well as ones that have to be paid for upfront.

My Top 9 Picks for Crypto Tax Software

Table of Contents

- 1 My Top 9 Picks for Crypto Tax Software

- 2 1. Koinly

- 3 2. Coinpanda

- 4 3. CoinLedger

- 5 4. Taxbit

- 6 5. CoinTracking

- 7 6. TokenTax

- 8 7. ZenLedger

- 9 8. Ledgible

- 10 9. Accointing

- 11 Main Factors to Consider When Choosing a Crypto Tax Reports Software

- 12 What is Tax Loss Harvesting?

- 13 FAQs

- 14 How much does crypto tax software cost?

- 15 What happens if I don’t file crypto taxes?

- 16 Do I need to report crypto if I didn’t sell?

- 17 How do you avoid high crypto taxes?

- 18 Final Thoughts on Crypto Tax Software

1. Koinly

Invented by a group of cryptocurrency investors and accountants, Koinly is the perfect platform to help you keep up with crypto tax filing. This software lets you import and monitor all your transactions.

As soon as you create an account and synchronize the wallets and exchanges, it generates tax reports for you. Here’s what to expect from this software:

Key Features

- Extensive support for crypto exchanges and wallets – unlike other tax software that supports just a handful of cryptocurrencies, Koinly integrates with a whopping 350 crypto exchanges. It syncs your crypto-related transactions, which then simplifies the tax filing process.

- Tax reporting – another thing that Koinly is good at is tax reporting. It generates the exact documents you need to file your taxes. US-based users are particularly lucky as they can generate already completed tax forms.

- Tax loss harvesting – this feature is designed to help you save money. It identifies your most profitable ventures and calculates the crypto profits/losses related to each one. Based on the results, it’s able to provide recommendations on how to maximize your savings.

- Seamless data import – if you’re looking to import your crypto transaction data, Koinly offers a range of services to facilitate this. It supports API format and manual CSV files.

- Additional resources – although its core function is tax report generation, Koinly offers a couple of other resources.

These include a Crypto Tax Calculator for computing tax calculations, a Tax Accountant list, Regional Tax Guides, and a blog to keep you abreast of the latest in the crypto world. This software even has an error reconciliation feature that identifies missing transactions.

Pro:

- Supports both API and CSV files

- Lets you invite an accountant to handle the tax filing process

- Compatible with up to 350 exchanges

- Ability to manually add and remove transactions.

Con:

- Does not allow cryptocurrency as a form of payment

Rating:

5-star/5-star rating

Pricing:

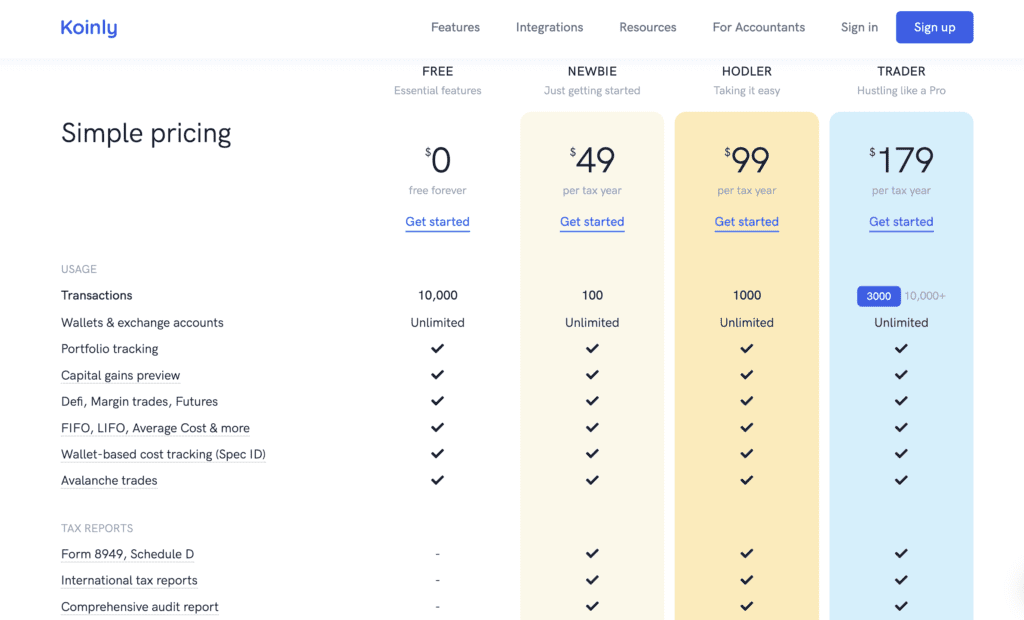

If you’ve never used crypto tax software before, Koinly’s free edition is a great place to start. It gives you a comprehensive overview of your taxes. And while it has no expiration date, it doesn’t generate reports. To do this, you’ll have to sign up for one of these paid plans:

- Newbie – going for $49/annually, this plan offers 100 transactions, tax reporting, unlimited exchanges and wallets, margin trades & DeFi as well as portfolio tracking.

- Hodler – this plan costs $99 yearly and offers 1,000 transactions. You’ll also have access to everything offered in the newbie package.

- Trader – for $179 yearly, this plan has a maximum of 3,000 transactions, tax reporting, unlimited exchanges and wallets, margin trades & DeFi as well as portfolio tracking.x

- Pro – high-volume traders will benefit from this plan which offers up to 10,000 transactions. It’s priced at $279 for every tax year.

2. Coinpanda

Even though it was invented just a few years ago, Coinpanda has become one of the most trusted crypto tax software. Not only does it help you to file taxes, but it also makes it easy to analyze your crypto portfolio. Plus, it supports more than 75 wallets, 500 exchanges and 125 blockchains.

That said, Coinpanda can be a bit expensive for high-volume traders. Although its Trader and Pro plans are relatively affordable, you’ll have to part with a chunk of money once you exceed 3,000 transactions.

Key Features

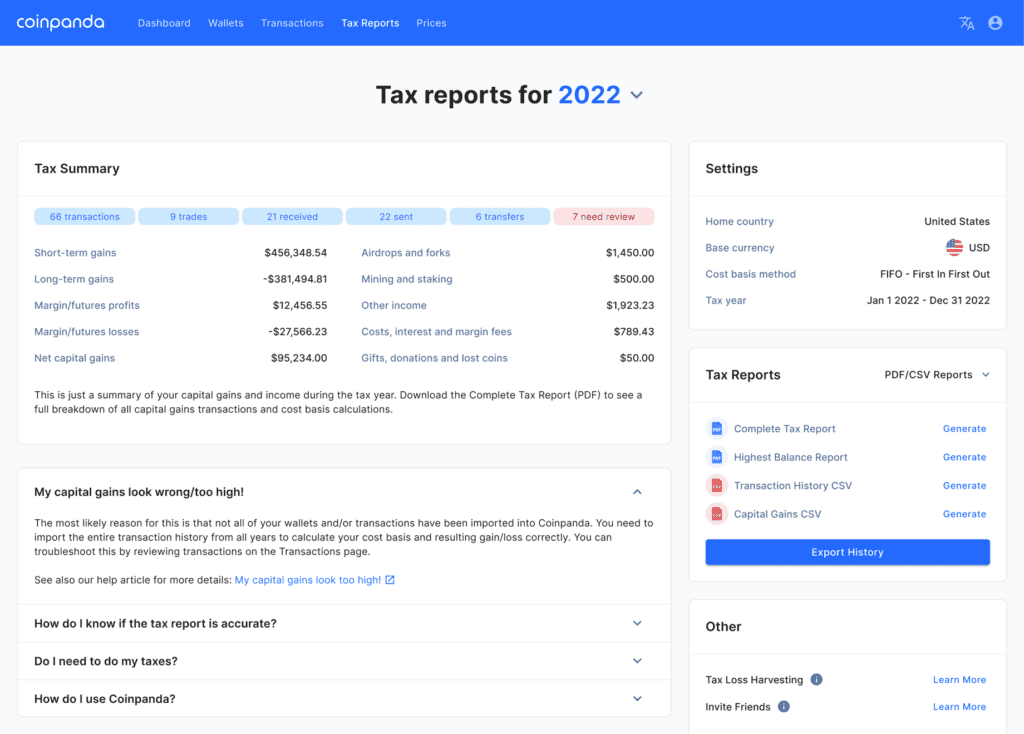

- Capital gains report – one of the biggest highlights of this tax software is the capital gains report. It compiles all your crypto transactions into one comprehensive spreadsheet, making it easy to analyze.

The spreadsheet usually includes ten categories as follows: Date Acquired, Date Sold, Assent Amount, Proceeds, Cost Basis, Gains/Losses, notes, transaction type, and Holding Period.

- Generates up to three crypto tax reports – Coinpanda makes it incredibly easy to pay tax on your cryptocurrency assets. It offers three ready-to-file tax forms, that is, Schedule D, Schedule 1 and Form 8949.

- Staking, lending & DEFI support – Coinpanda also helps you compute taxes on the incomes you get from DeFi transactions, such as yield farming, ICOs, mining, and staking.

- Portfolio tracking – if you’ve invested in different crypto platforms, you’ll benefit from Coinpanda’s portfolio tracking feature.

It’s designed to synchronize transactions from all the crypto exchanges and wallets that you own. This lets you know just how much you have, and the taxable events.

- Widely available – Having been launched in more than 65 countries, Coinpanda is able to generate country-specific tax reporting forms.

- Harvesting tax losses – the tax loss harvesting feature helps you decrease the amount of tax you’ll pay to the bare minimum.

Pro:

- Supports a wide range of cryptocurrency exchanges and wallets

- Generates multiple tax reports

- Offers country-specific tax forms for 65+ countries

Con:

- Can be pricey for high-volume traders

Rating:

4.8-star/5-star rating

Pricing:

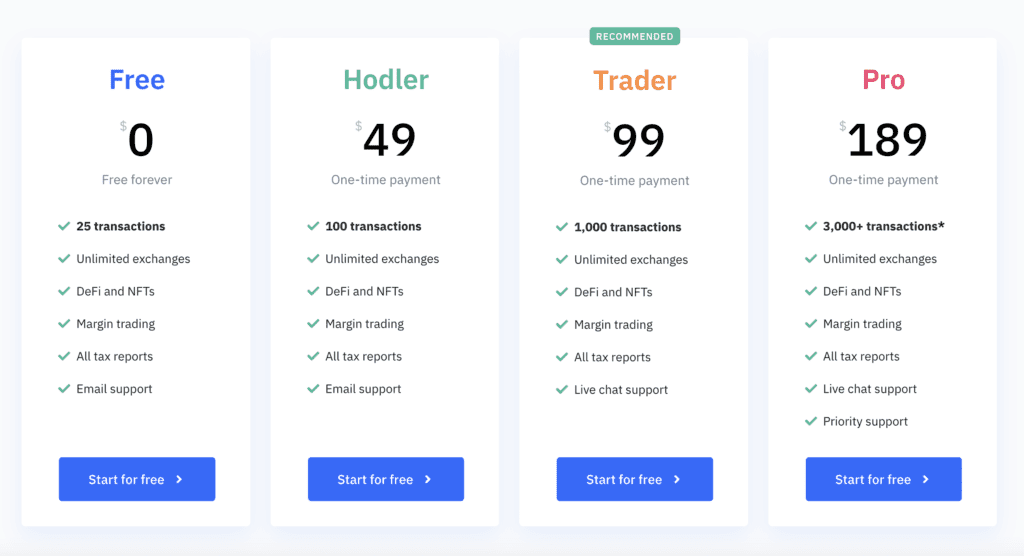

Coinpanda lets you choose from four pricing plans:

- Free – the free plan offers a maximum of 25 transactions, DeFi & NFTs support, email support, margin trading, unlimited exchanges and all tax reports.

- Hodler – going for $49, this plan increases the limit for transactions to 100. You also get everything else offered under the free package.

- Trader – for $99, this plan offers 1,000 transactions, live support and every other feature available on the free plan.

- Pro – their top-tier package sets you back $189. It offers up to 3,000 transactions, DeFi & NFTs support, margin trading, unlimited exchanges, all tax reports, live chat support and priority support.

3. CoinLedger

Shopping for a crypto tax program on a shoestring budget? If you are, you’ll be pleased to learn about CoinLedger.

Formerly known as Cryptotrader.tax, it’s one of the most affordable tax solutions available. It has a free plan and the mid-range packages are some of the most fairly priced. Here’s a closer look at its features:

Key Features

- Easy integration with tax programs – one of the biggest highlights of this software is its easy integration. Specifically, it integrates with four different tax programs, which makes crypto tax filing a breeze. The supported applications are TurboTax, TaxSlayer, TaxACT and H&R Block.

- Tax loss harvesting – CoinLedger has one of the most intuitive tax harvesting tools. It compares and contrasts the cost-basis of crypto transactions to the current prices in the market. This way, it’s able to determine unrealized losses that can be used to offset capital gains.

- Ease of monitoring your crypto portfolio – another thing you’ll love about CoinLedger is that it consolidates all your crypto holdings in one document. This then makes it easy to monitor each one and analyze their performance.

Pro:

- Compatible with conventional tax programs

- Has a 14-day money-back guarantee

Con:

- Tax forms are not available on the free plan

Rating:

4.8-star/5-star rating

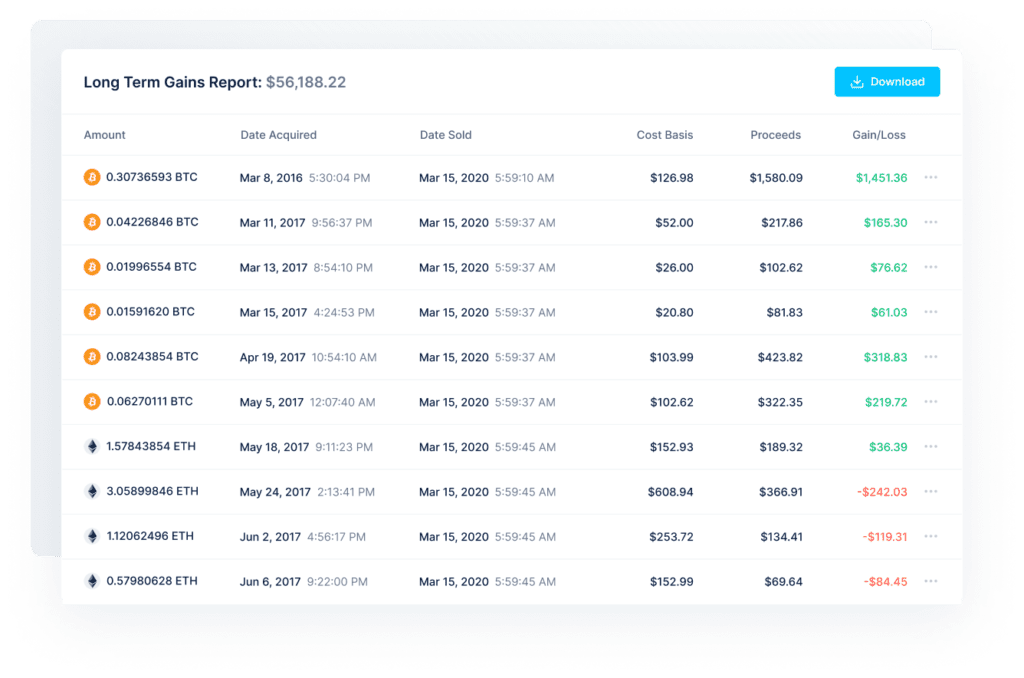

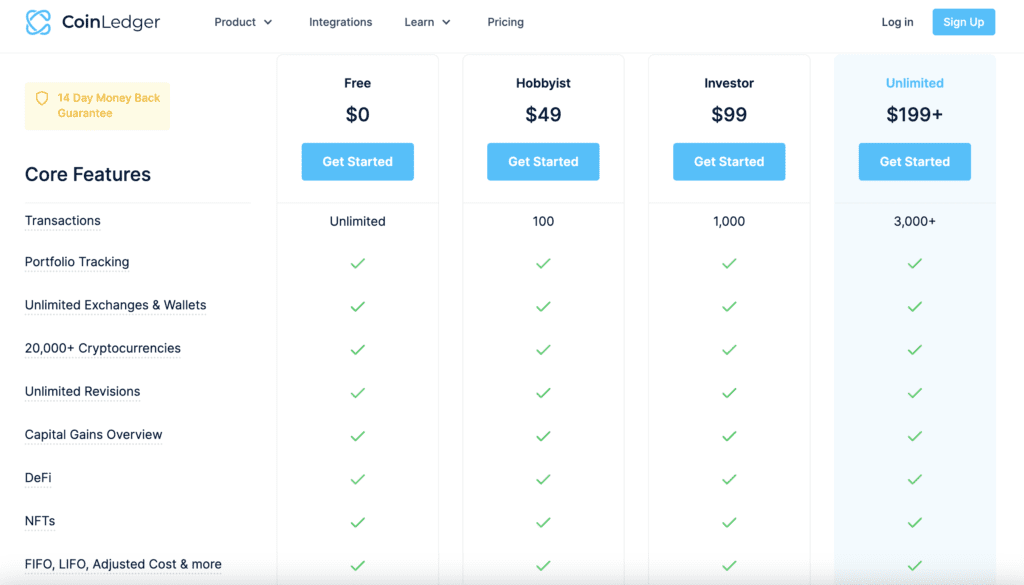

Pricing

- Free – interestingly, this free tier has no limit on the number of transactions. It includes several handy features, such as portfolio tracking, and capital gains overview. However, you’ll miss out on integrations and tax reports.

- Hobbyist – this plan goes for $49 and allows for 100 transactions. In addition to the basic features, this plan is compatible with different tax programs and provides an array of reports.

- Investor – for $99, this tier permits a maximum of 1,000 transactions. You’ll also get seamless integration with tax platforms and a range of reports.

- Unlimited – if you prefer the top tier, be ready to part with $199. Here, you’ll get a maximum of 3,000 transactions, integration with tax platforms and a variety of reports

4. Taxbit

Nowadays, there’s no need to hire tax professionals to file taxes for your crypto trading activities. Instead, all you need is quality crypto tax software like TaxBit.

This platform was actually created by a group of CPAs and tax attorneys. It’s user-friendly and is able to track cryptocurrency profits in real time. Factor in its ability to generate year-end crypto tax reports and you end up with the best crypto tax software.

Key Features

- Real-time reporting – the fact that it provides reports in real-time is one of the most attractive features of this cryptocurrency tax software. It not only shows your portfolio’s value but also the crypto gains that are subject to tax. This allows you to plan ahead and pay taxes on time.

- Free tax forms – once you sign up to the TaxBit network, you’ll be able to generate tax documents with TaxBit for free! The icing on the cake is the fact that there’s no limit on the number of transactions.

- Tax loss harvesting tool – this software is also designed to offer tax loss harvesting. This allows you to use the losses you incur from crypto trades to minimize the final tax payable.

- Premium security and support – another thing I love about TaxBit is that it offers its users maximum security. It relies on AWS RDS servers, which allow for the encryption of all the data.

TaxBit also has one of the best support systems. If you have any crypto tax questions, it allows you to schedule a call with an expert; once every year. However, this feature is only available to Pro users.

Pro:

- TaxBit offers a detailed portfolio performance analysis

- Users on the Pro plan can arrange a phone call with certified tax professionals to review their documents before filing

- Has a user-friendly dashboard that shows all your asset balances, unrealized gains and losses and your tax position

- Free tax forms making it the best tax software for beginners

Con:

- It’s purely web-based; doesn’t have tablet or smartphone applications

Rating:

4.5-star/5-star rating

Pricing:

TaxBit is one of only a handful of crypto tax software that’s completely free. Whether you’re looking to download tax forms or track your crypto assets, you won’t have to pay a dime.

5. CoinTracking

Cointracking has a long history that dates back to 2013. Initially, it was a crypto tracking software; hence, the name. But it’s since added an array of features, one of which is crypto tax reporting. Here’s a more detailed look at its features:

Key Features

- Generating tax reports – if you want software that can generate reports, CoinTracking is the ultimate crypto tax solution. In fact, it can generate country-specific tax reports for users in over 100 nations. You can also get information about your capital gains, income mining and more.

- Trade imports – another thing that makes this a great crypto tax tool is the fact that it simplifies data importing. You can import transaction data from 75+ exchanges and 20+ wallets. Better yet, you can use either CSV uploads or API transfers to copy this data.

- Crypto performance analysis – CoinTracking saves all the data related to your crypto trading activities in one place for easy analysis. It also provides profit and loss reports, realized & unrealized gains as well as audit reports.

- Professional support – there’s always a team of tax professionals available. So if you’d like an expert to review your documents before you file taxes, you’ll be able to. In fact, you can even request them to help you import transactions from your exchange accounts.

Pro:

- Lets you import data from most crypto exchanges and wallets

- Simplified process of generating reports and filing taxes

- Complies with a wide range of tax laws, such as the Capital Gains Taxation Act, and German Tax declaration among others

Con:

- The free plan doesn’t support integration of crypto tax reports

- The paid plans are charged yearly

Rating:

4.5-star/5-star rating

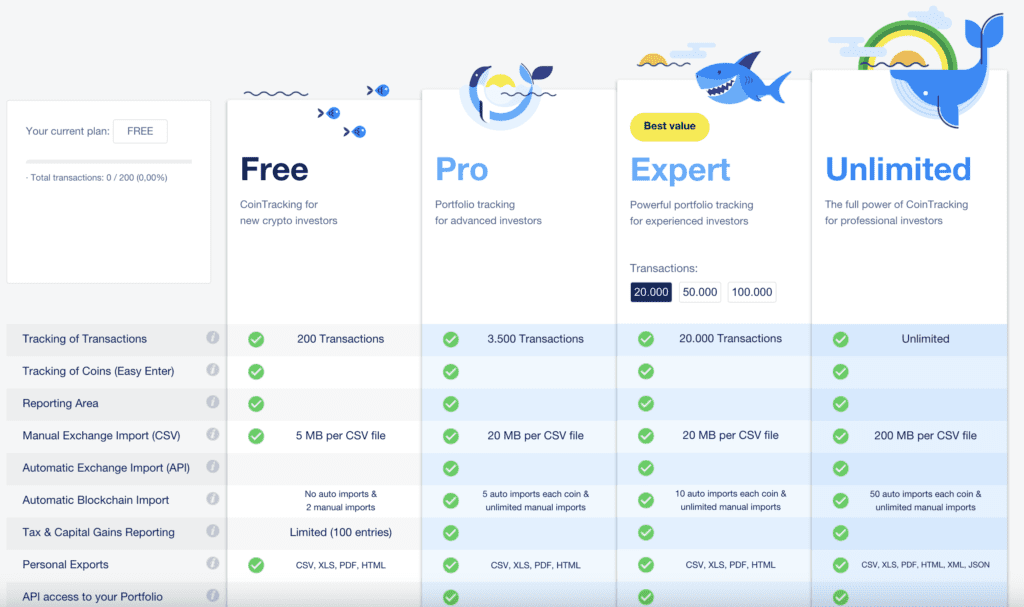

Pricing:

As with most cryptocurrency tax software, CoinTracking also offers a free version. Here’s a quick breakdown of its packages:

- Free – this plan limits the number of transactions to 200. It also offers maximum storage of 5 MB per CSV file, 2 trade backups and limited linking of multiple accounts.

- Pro – this plan currently costs $12.99 per month (billed yearly). It offers to track for 3,500 transactions along with 20MB per CSV file, 5 backups, unlimited linking of multiple accounts, and other exclusive benefits.

- Expert – this is a flexible plan that lets you choose from 20,000, 50,000 and 100,000 transactions. You will also get 20 MB per CSV file, 10 backups, unlimited linking of multiple accounts, and other exclusive benefits. It starts from $19.99/month (billed yearly).

- Unlimited – going for $69.99 per month, this package doesn’t have any limits on the number of transactions. You’ll also get 200 MB per CSV file, 20 backups, and everything else offered in the Expert plan. In addition, you’ll have access to Free Premium Support, Priority Customer Support, Advanced Tools and more.

6. TokenTax

Established back in 2017, TokenTax started out as a simple platform for importing data directly from Coinbase. It would then compute the individual user’s tax liabilities. As more crypto exchanges began, the firm added more integrations into the software. Here’s a more detailed look at its features:

Key Features

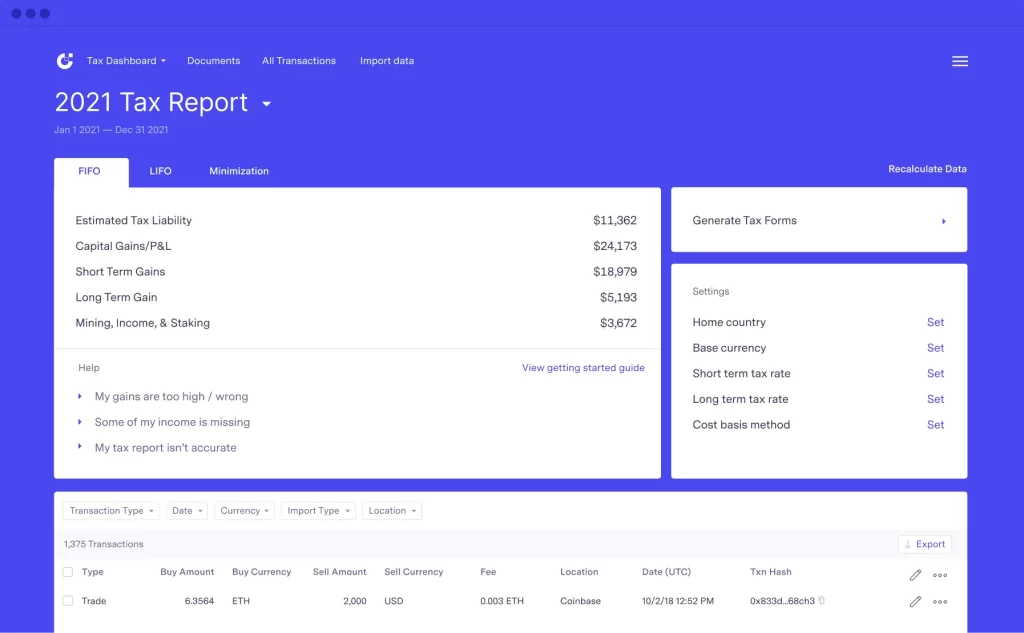

- Portfolio tracking – If you don’t want to wait until the 11th hour to calculate your cryptocurrency tax, TokenTax is the best tax software for you.

It helps you track and even preview your tax duties so that you don’t get caught unawares. The software generates almost every crypto tax report possible: LIFO, FIFO, average cost tax liability and more.

- Flexible system – another reason why I consider this among the best crypto tax software is its flexibility. You can choose to file cryptocurrency tax using the integrated TurboTax feature. Or, you can outsource this role to TokenTax CPA and the tax filing crew that’s available for hire.

- Tax loss harvesting – while you can’t avoid crypto taxes, you can find a way to minimize the taxable amount. This is where the TokenTax tax loss harvesting tool comes in handy.

It works by analyzing your NFT and crypto transaction history so as to identify the opportunities you can leverage. Essentially, it singles out the crypto assets you can use to counterbalance the capital gains; hence, minimizing the taxable amount.

Pro:

- User-friendly crypto tax software ideal for beginners

- Compatible with all the major exchanges

- Offers tax loss harvesting

Con:

- Steep pricing

- Bottom-tier plan has few features

Rating:

4.5-star/5-star rating

Pricing:

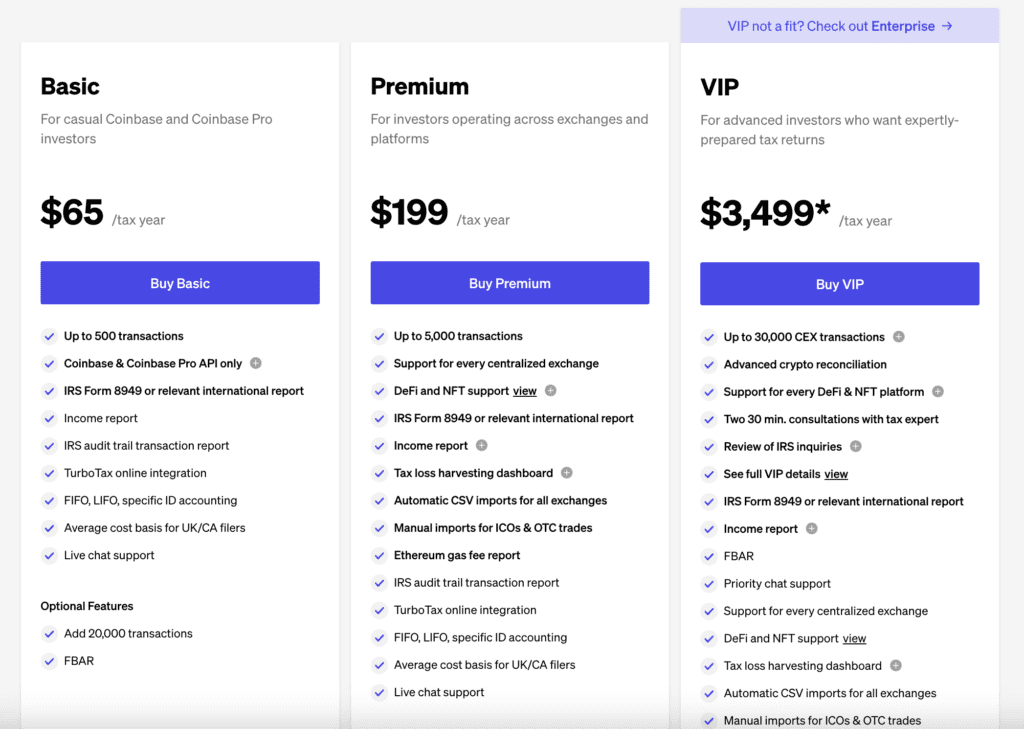

TokenTax is one of several crypto tax platforms that doesn’t offer any free trials. Your only option is to choose from one of these paid plans:

- Basic – this plan starts from $65 per tax year. It comes with a maximum of 500 transactions, IRS Form 8949, TurboTax integration, Income report, Coinbase & Coinbase Pro API only, IRS audit report, and live chat support.

- Premium – going for $199 per tax year, this plan offers everything available in the Basic package. However, the limit on transactions is 5,000, and it offers extras like automatic CSV imports, Ethereum gas fee reports, and tax loss harvesting.

- VIP – this top-tier package is quite expensive going for $3,499 annually. It offers at least 30,000 CEX transactions and everything offered in the Premium plan. For the price, you’ll get advanced crypto reconciliation, two half-hour consultations with a tax pro, and Priority chat support.

7. ZenLedger

ZenLedger is yet another option that’s worth looking into. Specializing in cryptocurrencies and NFTs, this crypto tax software helps you meet your tax obligations. In fact, it even integrates with TurboTax, enabling you to file taxes on every crypto asset you own.

Key Features

- Heavy DeFi support – one thing you’ll notice is that ZenLedger offers a ton of support for DeFi users.

Even though this fairly new niche is very lucrative, it can be pretty complex to grasp; more so for new traders. ZenLedger automates most DeFi-related tax events, making things easier for you. Plus, it integrates with more than 100 DeFi protocols.

- Offers downloadable tax reports – for starters, you’ll find it very easy to import crypto data from any wallet or exchange to your ZenLedger dashboard.

Once you do, the software helps you calculate capital gains and any additional income and then displays these details in the respective tax forms available for download.

- Tax loss harvesting – not every crypto tax software offers tax loss harvesting. Fortunately, ZenLedger does. The concept in play here is pretty simple: identify assets that can be sold at a loss and then use that to offset the capital gains.

- Excellent customer support – typically, all service providers offer some form of customer support. But what makes the ZenLedger crypto tax software stand out is that it offers every user full-fledged premium support. It doesn’t matter whether you’re using the free plan or the top-tier one.

- Professional tax assistance – ZenLedger goes the extra mile of providing expert help. Since it integrates with TurboTax, you can choose to file taxes on your own or invite your accountant to do so.

Alternatively, you can enlist the help of a ZenLedger tax professional at a fee. A 30-minute consultation (via phone) costs $295. Similarly, a one-year tax report costs $3500/per tax year while a multi-year report costs twice as much.

Pro:

- Massive support for DeFi applications

- Smooth tax filing thanks to the TurboTax integration

- All plans offer premium customer support

Con:

- Only high-end users can access DeFi support

- Localized tax forms are only available to users in the U.S.

Rating:

4.5-star/5-star rating

Pricing:

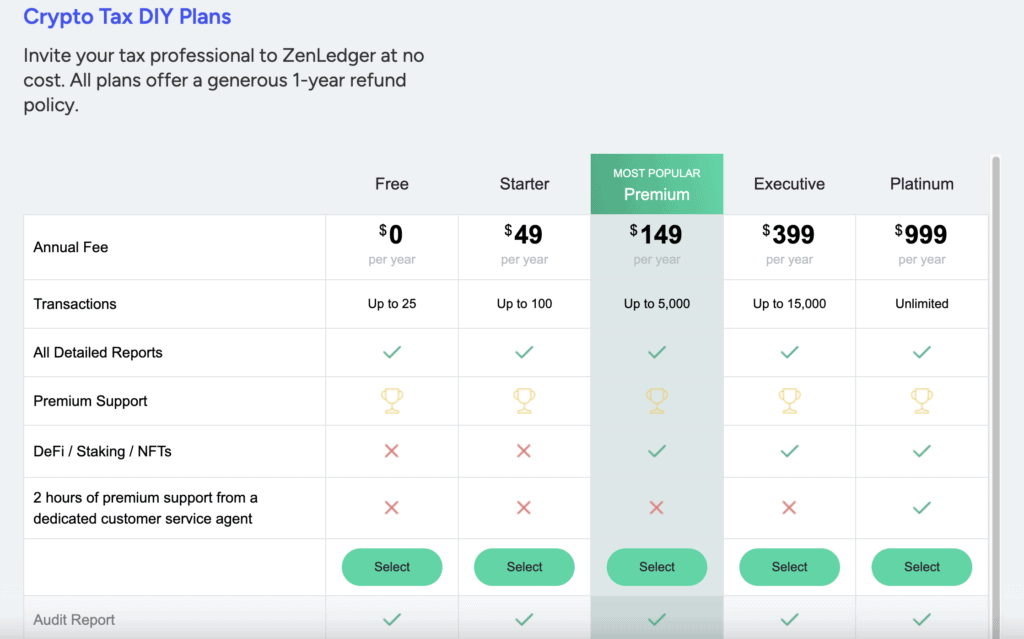

ZenLedger offers five different packages. Each plan automatically includes detailed reports and premium support. The packages are:

- Free – the limit on the number of transactions is 25. However, you’ll also get

- Starter – this one starts at $49 per year and allows for 100 transactions.

- Premium – for $149 per year, you get a maximum of 5,000 transactions and support for DeFi, NFTs and staking.

- Executive – this plan costs $399 annually and allows for up to 15,000 transactions. It also includes support for DeFi, NFTs and staking.

- Platinum – going for $999 per year, this plan offers unlimited transactions. In addition, you’ll get DeFi/ NFTs/ staking support and an extra 2 hours of premium support from a specific customer service agent.

8. Ledgible

Do you struggle to keep records of your crypto trades for tax purposes? If you do, Ledgible is an excellent crypto tax software. It determines your crypto tax obligations and efficiently sends data to the tax or accounting system that you have in place. Here are a couple more features to expect from Ledgible:

Key Features

- Premium tax reporting – Ledgible generates an array of reports that are useful when preparing to file crypto taxes. It’s also pretty good at keeping records of your trading activities. It achieves this by using an on-chain data aggregation technique.

- Crypto monitoring – this tax software also helps you to keep track of holdings moving between wallets and exchanges.

- Streamlines client workflow – the fact that Ledgible offers a client-centered workflow is a big plus! Tax professionals are able to track each client’s stage in the reporting task. Better yet, you can view the most recent balances, offer tax reminders and complete returns on behalf of your clients.

- Reasonable pricing plans – another feature that makes Ledgible an attractive crypto tax software is its flexible pricing. Whether you’re a tax expert or consumer, you can pay for plans depending on the number of transactions you complete.

Pro:

- Seamless integration with tax software systems

- Offers transaction matching for easy tracing of holdings

- Advanced security makes it a great crypt tax software for enterprises

Con:

- Does not have a mobile application

Rating:

4.2-star/5-star rating

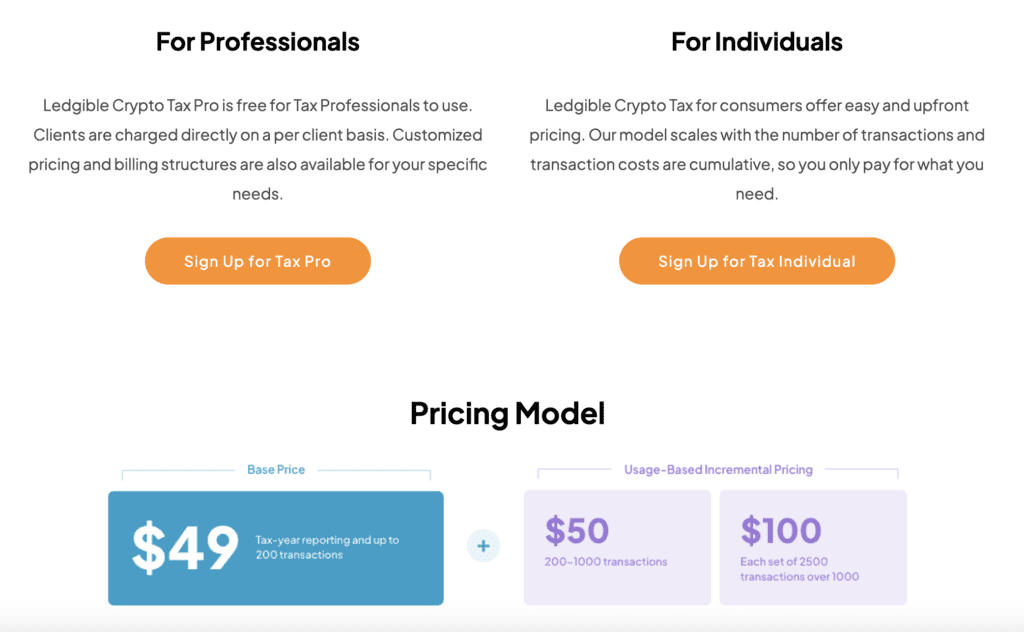

Pricing:

Ledgible offers a free trial. If you like the experience, you can then sign up for one of two packages. The first plan dubbed “Professional and Consumer Tax” starts from $49 for every tax year. The limit on the number of transactions is set at 200.

For transactions ranging between 200 and 1000, you have to part with an extra $50. Meanwhile, transactions that exceed 1000 call for an extra $100 for every set of 2500.

The second plan is known as “Enterprise Accounting” and it’s based on an on-demand pricing system. Essentially, this allows you to get a customized solution designed to address your business’ accounting needs.

9. Accointing

Accointing isn’t your average crypto tax software. Rather, it’s an advanced tool that helps you manage crypto taxes and your entire crypto portfolio. It has an intuitive interface that can be accessed through mobile or laptop. And it has a free version. Here’s a list of features that set Accointing apart:

Key Features

- Crypto data import and management – This software makes it easy to import data from over 300 wallets and exchanges.

Once you’ve imported, all the data is displayed in your crypto dashboard allowing you to track different aspects. These include the total value of your crypto assets, profits and losses, and holding periods among others.

- Management of crypto taxes – this software is also meant to help with crypto tax management. Specifically, it determines the taxable proceeds and generates individual report margin trades.

- Higher transaction limit – Accointing’s top-tier plan can generate reports for any user with up to 50,000 transactions. Even the lowest tier allows for a maximum of 25 transactions.

Pro:

- One of the most intuitive cryptocurrency tax software

- Relatively more affordable than other tax programs

Con:

- Doesn’t have certain integrations, making it a bit difficult to update data

Rating:

4.2-star/5-star rating

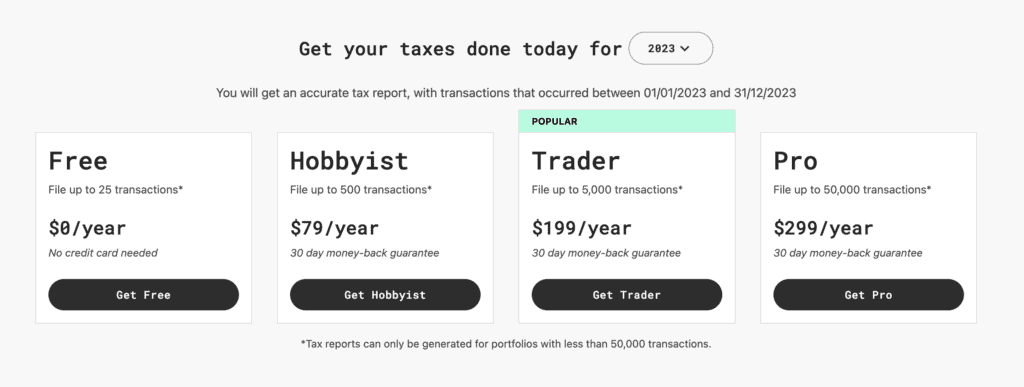

Pricing:

There are four plans to choose from as follows:

- Free – this lets you file about 25 transactions.

- Hobbyist – this plan costs just $79 yearly. It allows you to file a maximum of 500 transactions.

- Trader – this one costs $199 per year. It allows you to file 5,000 transactions and also includes a 30-day money-back guarantee.

- Pro – with a maximum transaction limit of 50,000, this tier costs $299 per year. It also comes with a 30-day money-back guarantee.

Whichever plan you subscribe to, you will also get a host of tracking features, support, data import and tax reporting.

Main Factors to Consider When Choosing a Crypto Tax Reports Software

Before you subscribe to any of these crypto tax software, keep these points in mind:

- Integrations – the first thing you should consider is the number of integrations supported by the software.

Generally, there are two main types: Comma Separated Values (CSV) and Application Programming Interface (API). API offers the best precision when importing data from a crypto wallet/exchange to tax software. Conversely, CSV imports take too much time.

- Bandwidth – another crucial factor you should account for is the software’s bandwidth. Unfortunately, most service providers don’t specify the bandwidth of their software. So you’ll probably have to look at the fine print or make a direct inquiry.

Although this sounds time-consuming, I guarantee you that it’s worth it, especially if you’re a high-volume trader. You don’t want to end up with a program that crashes each time you process thousands of transactions.

- Reliability – crypto tax software is a relatively new niche. And as such, you’ll want to check the credibility of a given program before you sign up.

Ultimately, you’ll have to pay tax based on the amount stated in the tax report so it’s good to do some due diligence before choosing any crypto tax software.

What is Tax Loss Harvesting?

Most retail traders would not have heard of the term “tax loss harvesting” the best way to describe it is a tax strategy that involves the sale of a cryptocurrency at a loss. The aim is to balance out any capital gains that may have been earned from the sale of other cryptocurrencies at a profit.

However, in order to claim a loss, the assets must be sold, and the proceeds must be used to purchase a similar asset within 30 days before or after the sale. This is referred to as the “wash sale” rule. The strategy works for individuals or businesses who have invested in multiple cryptocurrencies and seek to minimize their tax burden.

In most countries, the losses can only be offset against capital gains and not against other forms of income. Furthermore, there are constraints and limitations on the amount of loss that can be claimed within a taxable year.

FAQs

How much does crypto tax software cost?

The prices of cryptocurrency tax software vary widely. Some are available for free without any strings attached. Others start at $50 and yet others cost as much as $1000 for their top-tier plans.

What happens if I don’t file crypto taxes?

If the IRS or tax authority in your country audits you and finds that you haven’t filed your cryptocurrency tax, you’ll likely incur steep interest, penalty or even face criminal charges.

Do I need to report crypto if I didn’t sell?

No, you don’t. If you purchased crypto and opted to hold it in your wallet or other platforms instead of selling it, then you don’t have to pay any taxes. It’s the same way you’d buy shares and hold them in your portfolio.

The tax obligation only comes in if you dispose of the crypto asset. Whether you decide to use it as currency or sell it on a crypto exchange, you’ll have to report it on your tax documents.

How do you avoid high crypto taxes?

There are a couple of things you can do to reduce the crypto taxes you owe. These include:

- Holding the crypto asset for a longer period

- Leveraging losses to offset crypto gains

- Wait until the crypto tax rate reduces

- Donating crypto profits to charity

Final Thoughts on Crypto Tax Software

If you live in an area where you’re legally required to report your cryptocurrency income and pay the corresponding taxes, then investing in crypto tax software is a wise move.

This kind of software imports data from your crypto exchange or wallet and then calculates the resulting profits/losses. It then generates a tax form that’s specific to your country for easy filing. Most crypto tax software also tracks your crypto portfolio. This way, you’re able to monitor the crypto holdings you own across different wallets and exchanges.